I already discussed the impact of IFRS16 on the P&L and cashflow statement. Through the capitalization of operating leases as a ‘right-of-use’ asset together with an accompanying lease liability, IFRS16 also has an – at times material – impact on the balance sheet. This makes calculating a company’s EV/EBITDA tricky.

Pitfalls

In most cases the application of IFRS16 will increase both EBITDA as well as net debt. EBITDA increases since a part of the former lease expenses will be treated as a depreciation. Net debt increases since a lease liability is recognized for the first time on the balance sheet.

This creates a problem: Normally the (simplified) enterprise value of a company is calculated as market capitalization + net financial debt. Divided by the reported EBITDA figure yields the current EV/EBITDA of the stock.

Since both nominator and denominator are affected by IFRS16, it is paramount to either use pre-IFRS16 figures for both EBITDA and net debt or to include the lease liabilities in the net debt figure. Let us take a look at how and why.

Solutions

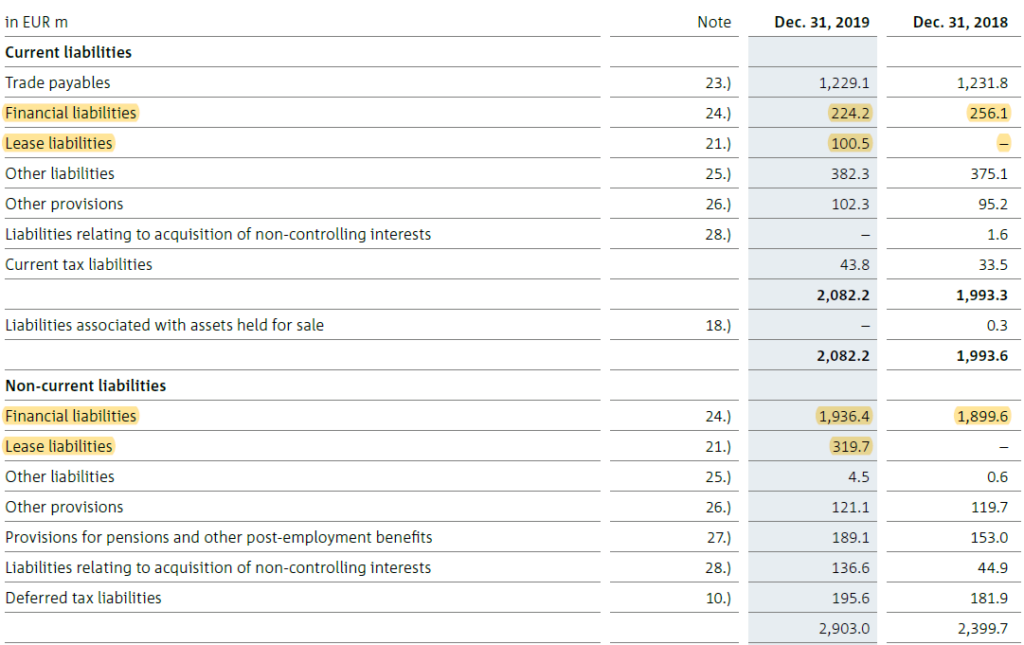

The following excerpt shows the impact of IFRS16 on the liabilities of Brenntag Group, the world’s largest chemical distributor based in Germany:

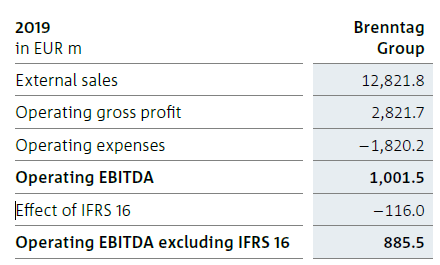

For year-end 2018 the calculation of the enterprise value is straight-forward: Simpy add the financial liabilities of 256.1m EUR + 1,899.6m EUR less cash and cash equivalents of 393,8m EUR to the then prevailing market capitalization and your are done. For year-end 2019 (the first year including the IFRS16 effect) the equation gets a bit more complicated, as the corresponding lease liabilities will have to be included in the net debt figure. Recognizing 520.3m EUR in cash and cash equivalents the relevant net debt figure for 2019 equates to -520.3m EUR + 224.2m EUR + 100.5m EUR + 1,936.4m EUR + 319.7m EUR = 2,060.5m EUR. As per October 2020, the company’s market capitalization amounts to 8,380m EUR, which yields an enterprise value of 10.441m EUR. The inclusion of the lease liabilities is crucial in order to compare EBITDA and enterprise value on a like-for-like basis. The company gives the EBITDA pre and post IFRS16 as follows:

The correct way to calculate EV/EBITDA in this case is to divide the enterprise value (including lease liabilities) of 10.441m EUR by the reported EBITDA of 1,001.5m EUR for an EV/EBITDA of 10.4. As you notice, both the nominator and the denominator have been increased by IFRS16, hence cancelling the distorting effect on this valuation metric largely out.

Many analysts these days do not get this effect and still calculate enterprise value the traditional way but ‘reap’ the benefits on the EBITDA side, hence wrongly obtaining too low valuation metrics.

Be aware the high-street

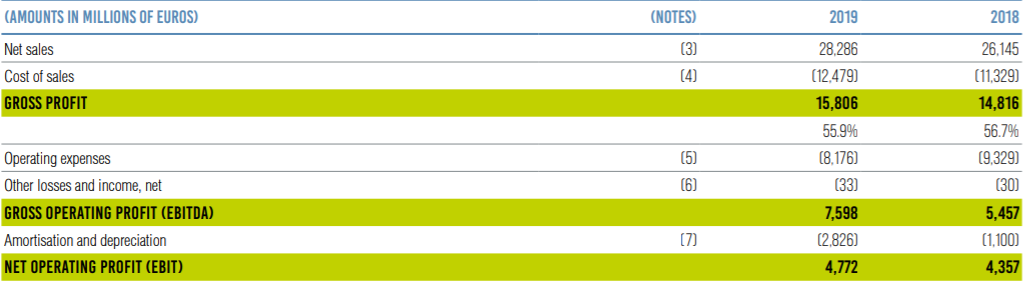

The effect mentioned above can be dramatic for companies that make extensive use of leasing contracts such as high-street retailers. Take a look at the below excerpt of Inditex’s profit and loss statement for the year 2019:

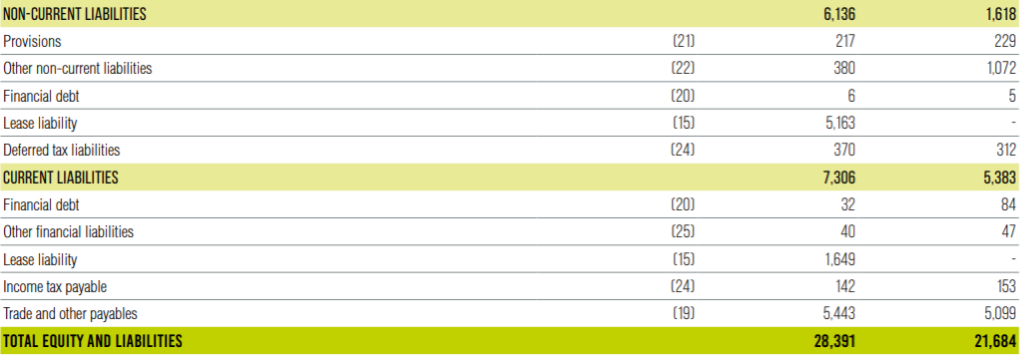

The sharp increase in EBITDA (by a whopping 2,141m EUR) should by now not come as a surprise anymore, neither should the accompanying increase in depreciation of 1,726m EUR. Comparing this IFRS16-inflated EBITDA to the company’s enterprise value obviously only makes sense when also taking into account the increase in liabilities. Whereas Inditex would have shown only a mere 38m EUR in gross financial debt in 2019 using the traditional formula, its gross debt increases to 6,850m EUR:

For investors not aware of this effect, the divergence in results can be startling: Calculating EV/EBITDA without taking into account the lease liabilities would yield a multiple of 9.6 as per October 2020. However correcting for the lease liabilities increases the EV/EBITDA to 10.5 with only the latter value reflecting the true economic reality.

The end of EBITDA?

This begs the question: Does it make sense to use EBITDA as a measure of profit and EV/EBITDA as a valuation metric anymore? Well, its difficult: On the one hand the EV/EBITDA measure can still be calculated correctly as long as the effects outlined above are correctly reflected in the calculation. On the other hand, EBITDA has always been a lousy profit metric to start with since depreciation and amortization are true costs to any business. Given the distortions of IFRS16 many companies have started to change their KPIs from EBITDA to EBIT, see here for example LafargeHolcim’s excellent CFO Géraldine Picaud explaining the thinking:

In closing, be aware of the new pitfalls and complexities introduced with the application of IFRS16, as the above-mentioned example of LafargeHolcim though demonstrates, IFRS16 might actually end up enhancing the financial reporting under IFRS as more companies will move away from EBITDA as the key performance measure.