Calculating financial ratios by itself does not necessarily create a lot of insight, with the true value-accretive steps being the interpretation of said data-points. I covered the definition and interpretation of financial ratios in depth in my book, however I noticed that readers often find it challenging to extract the correct figures from actual financial statement. This is no surprise since no financial statement looks quite like the other and often varying terms are used for one and the same accounting item. This is why this “how to calculate series” focuses squarely on the “calculation” part of the problem, using real financial statements and is mainly aimed at beginners and intermediate readers.

Calculating working capital ratios

- Days sales outstanding and days payables outstanding

- Inventory turnover

- Cash conversion cycle

Case study: Reece

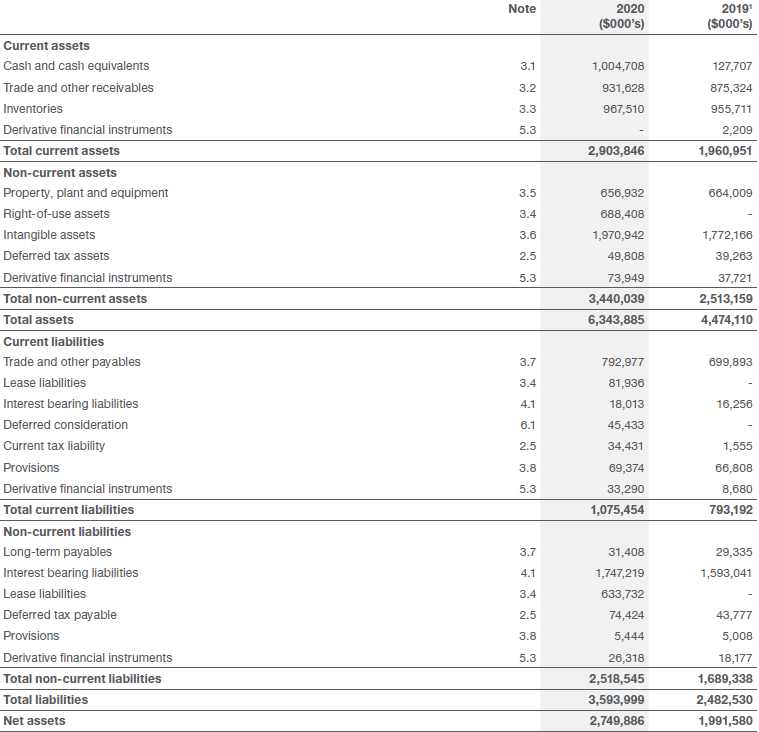

Reece is the leading Australian distributor of professional plumbing supplies. We will use their fiscal year 2020 financial statement to show how to calculate the aforementioned working capital ratios. The excerpt below shows the company`s balance sheet for fiscal 2020:

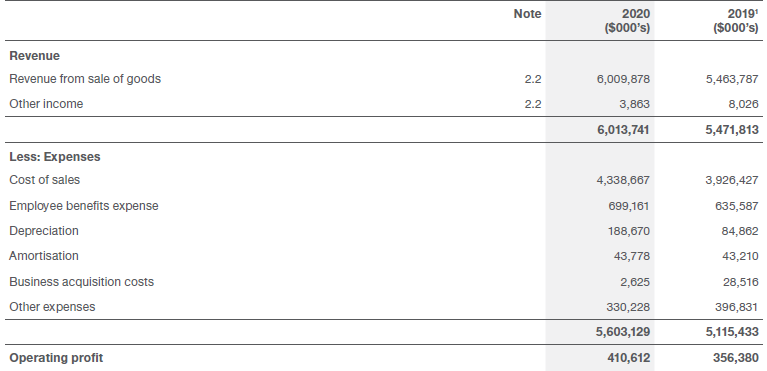

In addition to that, Reece recorded net sales of 6,013,741 AUD and associated cost of sales of 4,338,667 AUD in fiscal 2020 as shown in their profit and loss statement:

The days sales outstanding is calculated by dividing the year’s average account receivables times 360 by the net sales. The averaging is needed since we are comparing a yearly figure (net sales) with the receivables which are only shown for one point in time (in this case for the respective fiscal year ended 30 June 2020). Hence the average account receivables are calculated as: (931,628 AUD + 875,324 AUD) /2 = 903,476 AUD. Times 360 and divided by net sales of 6,013,741 AUD yields 54.1 days sales outstanding. In practical terms this can be interpreted as the company’s customers paying Reece on average after 54.1 days.

The counterweight to this ratio, the days payables outstanding, shows how quickly the company pays its own suppliers. This ratio is calculated by dividing the average account payables times 360 by the cost of sales. In this case the average accounts payable is (792,977 AUD + 699,893 AUD) / 2 = 746,435 AUD. Times 360 and divided by cost of sales of 4,338,667 AUD yields 61.9 days payables outstanding.

We can already see, this Reece is paying its own suppliers slower than its own customers settle their bills with Reece. This grants Reece in effect an interest-free loan.

However as a distributor Reece also needs to hold large quantities of inventory that bind capital. It is therefore of interest to see how quickly the company’s inventory turns over. The inventory turnover ratio is calculated by dividing the cost of sales by the average inventory. In this case the average inventory amounts to (967,510 AUD + 955,711 AUD) / 2 = 961,610 AUD which yields an inventory turnover ratio of (4,338,667 AUD / 961,610 AUD) = 4.51. This means that Reece’s inventory base turns over 4.5 times per year.

Dividing 360 by the obtained inventory turnover ratio yields the inventory days number of (360 / 4.51) = 79.8 which can be directly compared to the days sales outstanding and days payables outstanding.

Adding all three ratios together gives us the cash conversion cycle. This number shows for how long working capital is actually tied up within the company: Cash conversion cycle = days sales outstanding + inventory days + days payables outstanding. In this case the cash conversion cycle amounts to 54.1 + 79.8 – 61.9 = 72.0 days.