Subscription businesses are all the rage these days. Even many traditional companies are shifting their business models to gain a more recurring revenue base. From a valuation angle this shift from a transactional to a more subscription based monetization model opens up quite a few interesting possibilities to deeper analyze and understand the value drivers of a given business: its unit economics.

By looking at the unit economics (how much is each customer/product worth) we can significantly deepen our understanding of what’s going on under the hood. I gave a primer on this topic in a podcast with the guys of ValueDACH (in German) and want to use this series to take a deeper yet bite-sized looked into this topic.

The teaser: Howard Stern joins SiriusXM

Earlier this year, Joe Rogan’s move to Spotify for a purported 100m USD (we might just call this another form of customer acquisition costs) made big waves, but this deal pales – in financial as well as historical terms – in comparison to Howard Stern’s move to SiriusXM (back then just “Sirius” before its merger with “XM”) at the beginning of the millennia.

Back in 2004 Howard Stern – then by far the most popular radio host in the US with more than 15 million daily listeners – decided to jump ship from (free) terrestrial radio to the relatively unknown upstart SiriusXM, a provider of (monthly paid) satellite and online radio services, sporting at the time a mere 700,000 subscribers. In this highly recommended appearance on the David Letterman show Howard Stern outlines his reasoning:

He argues that “I am the first broadcaster to walk away from an empire” and that “I do not think I am committing suicide going to paid radio”. Later on he predicts that (where the linked video starts, although I recommend watching it from the beginning) “I believe in five years, give me five years […] satellite radio will be the dominant medium […] it will be satellite, and it will be Sirius”. Towards the middle of their talk Letterman states “in many ways you pioneered the modern radio culture” to which Stern interrupts, stealing the punchline, “and now I am here to destroy it”. Why is this important to valuing subscription businesses? – Well, SiriusXM paid Stern a whopping 500m USD for his first five years at the company (remember, this was back in 2004).

Whilst most people were outraged by a broadcaster being paid a three digit million figure per year, few actually ran the numbers: Stern had millions of loyal radio listeners and SiriusXM charges 12 $ a month, the question is then: how many have to follow him to make the numbers work? At 144 $ a year per subscriber (assuming 100 % incremental margins for the moment) it only takes a surprisingly low number of roughly 700,000 subscribers to join SiriusXM to reach break-even on Sterns 100m USD per year contract. In fact, just two years after joining the company, SiriusXM sported 8.4 million subscribers as Stern boasted during his next (again very entertaining) appearance on the Letterman show:

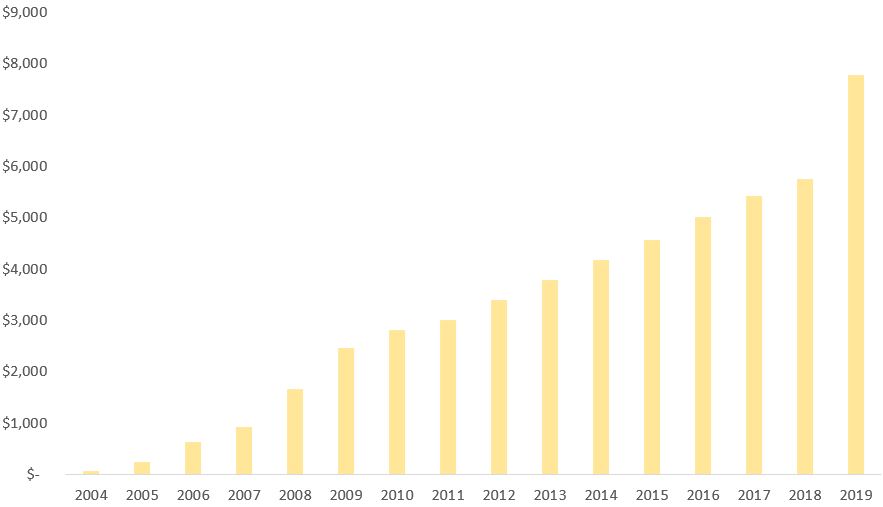

This is a big lesson: In a world of no- to low-incremental costs per new subscriber, seemingly insane absolute customer acquisition costs can turn out to be bargains. Take a look at the revenue and profit figures for SiriusXM since Stern joined the company:

Using the 7.7 million incremental subscribers during the first two years as a crude proxy yields customer acquisition costs of about 26 USD per sub (200m USD/7.7m subs), which equates to a payback of around two months on a revenue basis and four months if we assume 50 % incremental margins per subscriber. We will look deeper into how these numbers actually look like for comparable businesses in this mini-series. For now remember that in a digital-first world, customer acquisition costs can look irrational at first, but have far reaching and non-linear outcomes, for example because of low incremental margins or network effects.

Analysing subscription businesses: a mini-series

The above case study highlights the first steps to value any subscription business: how much do we spend per customer and how much do we earn per customer? In the following parts of this series I want to tackle these one by one. First we need to understand the key ingredients making up the unit economics, which will be covered in part 2:

- Customer acquisition costs

- Churn

- Average revenue per customer

- Contribution per customer

With these key variables we can then calculate the following metrics that will be presented in part 3:

- Customer lifetime value

- Payback period

- Standstill profit

Often subscription-based businesses will provide additional metrics and we will dive deeper into the meaning of those in part 4:

- Cohort analysis

- Net dollar retention rate

And finally we will put all this together to look into possible valuation methods in the final part 5:

- Subscription-based discounted cashflow models

- EV/Sales

Thinking about concepts such as customer lifetime value, unit economics and customer acquisition costs make sense not just for pure subscription businesses such as SaaS providers, but also traditional companies: think about it, at the end of the day paying an expensive rent for a high-street office or store can be (at least partly) seen as a form of a customer acquisition cost. This is the first key ingredient in determining the unit economics, which we will tackle soon in part 2 of this mini-series.